EUR/USD: Pair Nears 16-Week Low, Stays Negative

EUR/USD extended its downward movement on Tuesday, retreating about 0.16% and testing a key technical barrier that could lead to fresh 16-week lows if the price breaks below this support level.

European Central Bank President Christine Lagarde made several appearances on Tuesday, but her remarks, which were fairly generic, did little to support the euro. Lagarde noted that the ECB “is not unhappy with what it has seen” and added that the ECB “cannot conclude that inflation targeting is a given.” These comments failed to inspire much confidence and had little impact on currency markets, with the euro continuing to retreat in response to a stronger dollar for the fourth consecutive week.

World PMI indices will be released on Thursday, and markets currently hold high expectations for the pan-European PMI survey results. The median of market estimates points to a slight rebound in the October EU services PMI to 51.6, up from 51.4 in September.

At present, the market views the ECB as more hawkish than the U.S. Federal Reserve. Financial markets are less convinced of the need for a rate cut in the U.S., given better-than-expected economic data, which suggest the U.S. economy is gaining momentum heading into the final quarter of the year. The Fed is expected to cut U.S. rates again in early November, but likely by only 25 basis points, not the 50 basis points previously anticipated. The Fed is also expected to urge caution regarding future rate cuts.

With less than two weeks until the U.S. presidential election, analysts suggest that the dollar’s recent behavior is tied to indications that Donald Trump is the favored candidate to win. His trade policy, which emphasizes tariffs, and his generous tax cut proposals are thought to support dollar strength. Fouad Razakzada, an analyst at City Index, notes: “With Donald Trump gaining ground in the polls, markets have started to factor in a potential victory, which could keep the U.S. dollar supported.”

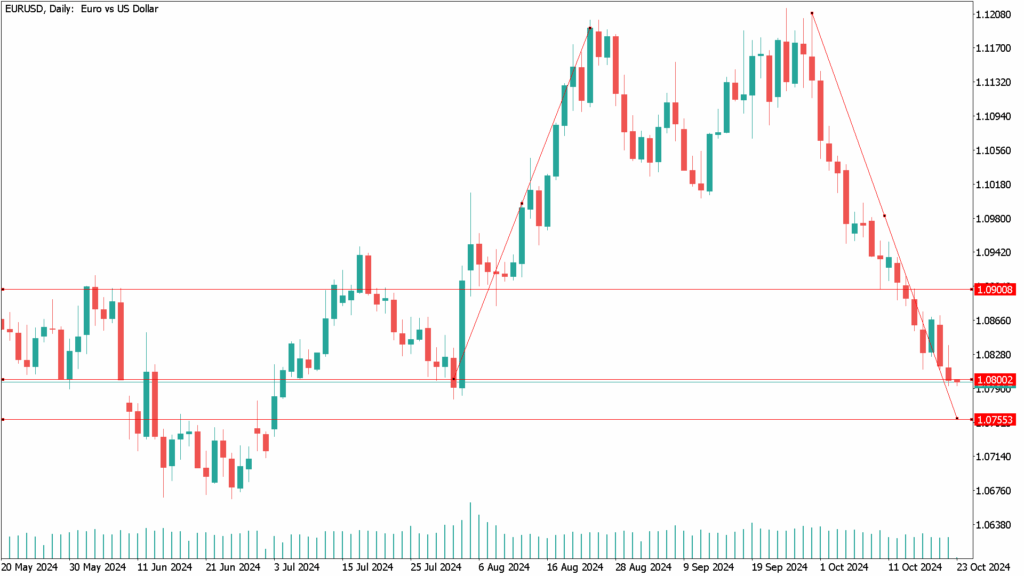

EUR/USD Daily Technical Analysis for October 23rd:

EUR/USD continues to trend lower and remains under pressure, trading around the 1.0800 mark. The pair has been declining since mid-September, breaking key support levels and now testing the 1.0800 level. The 50-day exponential moving average (EMA) is at 1.0983, while the 200-day EMA is slightly above at 1.0909. The price is trading below both EMAs, confirming that the short- to medium-term trend is bearish. As long as the pair remains below these levels, the downtrend is expected to continue, with 1.0750 acting as the next major support zone.

From a momentum perspective, the MACD indicator signals solid bearish momentum, with the MACD line extending further below the signal line. The histogram is in negative territory, indicating that the current downtrend may persist in the short term. A break below the psychological 1.0800 level could accelerate declines toward the next support around 1.0750, while any recovery would require a move above the 1.0900 level to suggest a possible change in trend.