EUR/USD The Pair Rises Ahead of U.S. Elections

The EUR/USD recovered some losses from the previous session, trading near 1.0880 in early Asian trading on Monday. This rise may be due to a softer U.S. dollar following weaker-than-expected October Non-Farm Payrolls data. However, uncertainty surrounding the U.S. presidential election could drive safe-haven demand, limiting the pair’s upside potential.

On Friday, U.S. Bureau of Labor Statistics data showed that NFP for October increased by only 12,000, following a revised September gain of 223,000, well below market estimates of 113,000. The unemployment rate remained steady at 4.1% in October, aligning with consensus forecasts.

According to a recent New York Times poll cited by Reuters, Democratic candidate Kamala Harris and Republican candidate Donald Trump are locked in a close race across seven key states just days before the presidential election. The poll indicates Vice President Harris has a slight lead in Nevada, North Carolina, and Wisconsin, while former President Trump leads narrowly in Arizona. The candidates are in a tight race in Michigan, Georgia, and Pennsylvania, with results within the poll’s 3.5% margin of error.

The euro was bolstered by stronger-than-expected economic growth in the third quarter and higher-than-expected inflation in the eurozone. This has led traders to revisit expectations for a larger-than-usual rate cut by the European Central Bank in December. Markets have fully priced in a 25 basis point cut to the ECB’s December deposit rate, marking the fourth cut this year after similar reductions in October, September, and June.

Preliminary data revealed the Eurozone’s Harmonized Index of Consumer Prices rose to 2.0% y-o-y in October, up from 1.7% previously and exceeding the 1.9% estimate. The annual core inflation rate remained stable at 2.7%. Additionally, the Eurozone’s GDP grew by nearly 0.4% quarter-on-quarter in the third quarter, more than doubling the second-quarter growth and surpassing estimates of 0.2%.

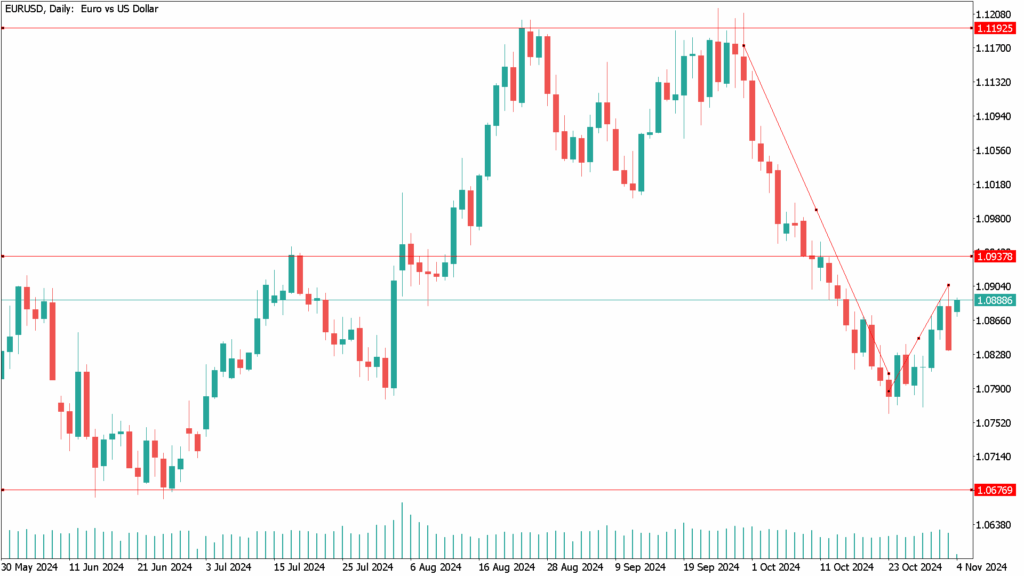

EUR/USD Daily Technical Analysis for November 4th:

The euro market has rebounded slightly over the week, though it appears to be struggling to hold onto gains. Expect the market to remain volatile and range-bound around the 50-week EMA. A break above the top of the recent candle could push the market toward the 1.10 level. Conversely, the 1.0750 level serves as a critical support level to watch closely. Should it break below this level, the market may head toward 1.05, which has been a significant support level multiple times over recent years. In short, this market seems to lack clear direction and remains somewhat uncertain.