GBPUSD Dips Ahead of BoE Decision

Today marks a key policy day, with interest rate decisions due from both the European Central Bank and the Bank of England. The latter is of particular interest.

The UK economy has been slowing steadily over recent quarters. Annual GDP growth has decelerated from 1.9% in Q4 2024 to 1.3% in the same period of 2025. Labour market conditions are also showing signs of softening, with the headline unemployment rate rising from 4.7% in July 2025 to 5.1% in November, the latest available reading.

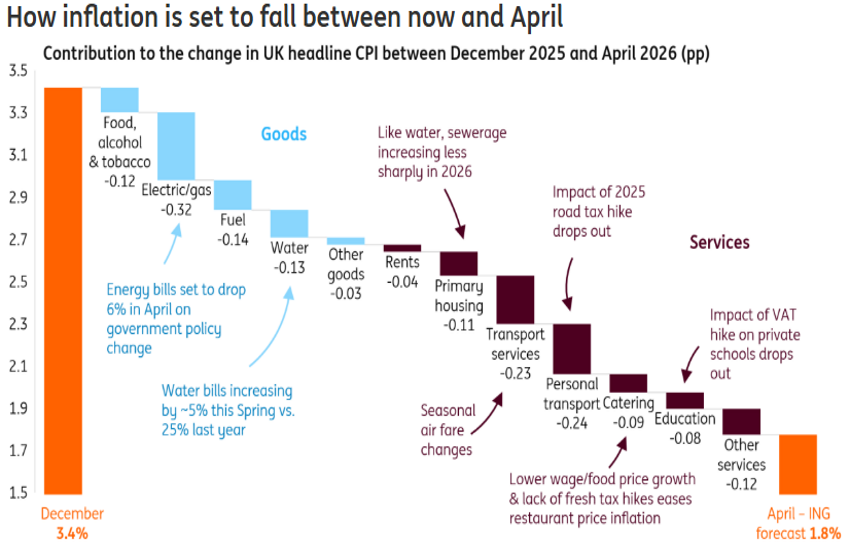

Inflation remains the highest among developed markets, currently at 3.4%. However, the outlook is becoming more constructive. Major CPI components point to meaningful disinflation over the coming months, with headline inflation potentially falling toward 2% by April. Utility prices (water and gas), food costs, housing-related expenses, and transportation are all expected to ease between now and April (see chart, source: ING).

Against this backdrop, we expect the Bank of England to continue cutting rates over the course of the year, though not at today’s meeting. Market consensus anticipates at least 50 bps of additional easing, with the first move potentially as early as March, provided incoming data confirm the disinflation trend. UK CPI releases will therefore become a critical data point to monitor.

TECHNICAL ANALYSIS

Following the late-January rally that lifted GBP/USD from 1.3400 to 1.3870—largely driven by U.S. dollar weakness—the pair has come under renewed pressure, retracing approximately 1.61% as of last night’s close. A technical rebound in the U.S. dollar has been a key driver, with the Dollar Index recovering from its January 27 low of 95.36 to the 97.50 area, where it trades this morning.

Given markets’ forward-looking nature, expectations surrounding the Bank of England’s policy path—outlined above—are also likely contributing to the recent price action.

From a technical standpoint, GBP/USD broke above a descending trendline on January 23, stalled, and now appears to be undergoing a textbook pullback. The primary target aligns closely with this morning’s low near 1.3810. Beyond that, two additional areas of interest stand out at 1.3660—near today’s opening level—and 1.3580.

While not visible on the current chart, the 1.4250 area remains a significant long-term resistance and upside reference. The pair came close to this level during the rally that began in April 2025 from the 1.2150 area (with the long-term trendline originating from that period still intact). Momentum indicators are now turning lower, with RSI trending down and the MACD histogram crossing below its signal line today.

Although other major central banks may also move toward more accommodative policy later this year, we believe the Bank of England could act more aggressively. As a result, we do not rule out a deeper extension of the current GBP/USD correction beyond today’s retest of the former downtrend. Key levels to monitor are the psychological 1.35 handle and, more importantly, the 1.34 area. The expected time horizon for such a move is several weeks.