Gold and Silver Surge Toward New All-Time Highs

In recent weeks we have discussed both metals, not only in light of the strong performance delivered over the past couple of years—particularly throughout 2025—but also because of their growing popularity among retail investors, especially gold.

Regarding XAU, we were not expecting outsized further appreciation. We analyzed it when it was trading around $4,050; after reaching USD 4,386, the price retraced below $4,000 before finding renewed buying interest. At that time, we stated that the yearly highs had likely been set and that prices would probably remain close to, but below, those levels. Our stance on silver was far more constructive: it was trading around $54 and, in the event of a breakout, we saw meaningful upside potential.

We have been partially vindicated. XAG continued its rally with strong momentum throughout December and reached $70 this morning—an impressive +31% for the month. Gold remained near its highs until last Friday and then took advantage of yesterday’s and today’s low-volume sessions to break decisively above them before year-end. It is currently trading at $4,487 (yesterday gold gained +2.72%, while silver rose +3.10%).

In this type of market configuration, technical analysis offers limited insight. Prices are operating in uncharted territory, with the only clear reference being the prior highs, while momentum indicators are understandably overbought—something that does not, in itself, imply an imminent trend reversal. Investors already positioned may consider letting profits run while progressively adjusting stop levels; those not yet involved should exercise caution in timing any new entry.

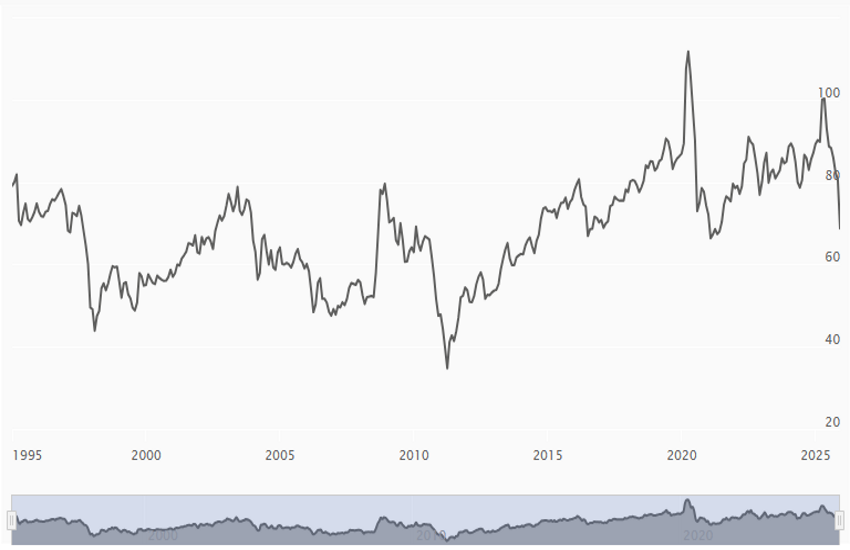

Finally, we reiterate the sharp compression in the gold/silver ratio observed over recent months, which highlights a pronounced investor preference for XAG. The ratio has collapsed from around 100 to just over 60 since April. It now stands at levels that are more historically “normal” (at least within this millennium) and may suggest that, in the near term, we could see some rebalancing in relative performance between the two metals, with silver potentially ceasing to decisively outperform gold.