JPM in Focus as Private Credit Fears Rise

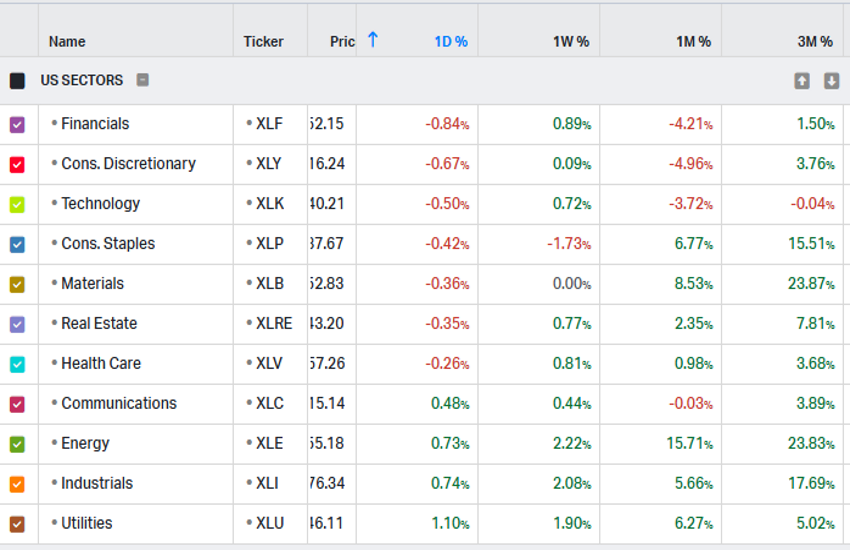

It was another negative day, albeit only slightly so on Wall Street, but this time the “novelty” was that the most heavily sold sector was not technology, but financials. With a daily performance of -0.84%, financials saw greater selling pressure than consumer sectors (Discretionary -0.67%, Staples -0.42%), dragging down primarily the DJ30, which was the weakest among the major indices with a performance of -0.54%.

In recent years, several non-traditional market segments have attracted significant investor attention and delivered strong growth, with private credit perhaps the leading example. This is a non-bank lending strategy in which capital is extended to companies—typically mid-market firms or those with complex profiles—outside the public bond markets or traditional banking system. Unlike public fixed income, these are privately negotiated transactions that offer investors an illiquidity premium and higher yields, usually structured as floating-rate senior secured debt. From a corporate perspective, private credit provides a flexible and confidential alternative to the rigid underwriting standards of commercial banks; for institutional portfolios, it serves as a sophisticated instrument for generating risk-adjusted alpha and diversifying away from the volatility of public benchmarks. The sector, which is increasingly reaching retail investors—especially in the U.S.—has ballooned into an approximately $3 trillion global market.

Yesterday, news emerged that one of the industry’s giants, Blue Owl Capital, had forcibly liquidated $1.4 billion in loan assets from three of its private credit funds and permanently suspended withdrawals from those funds (which were indeed targeted at retail investors).

This development has raised further concerns about the soundness of a market inflated by years of abundant liquidity and, at the same time, has weighed on the broader financial sector. Let us briefly look at the largest U.S. bank, JP Morgan Chase, generally characterized by its strong focus on maintaining a robust balance sheet.

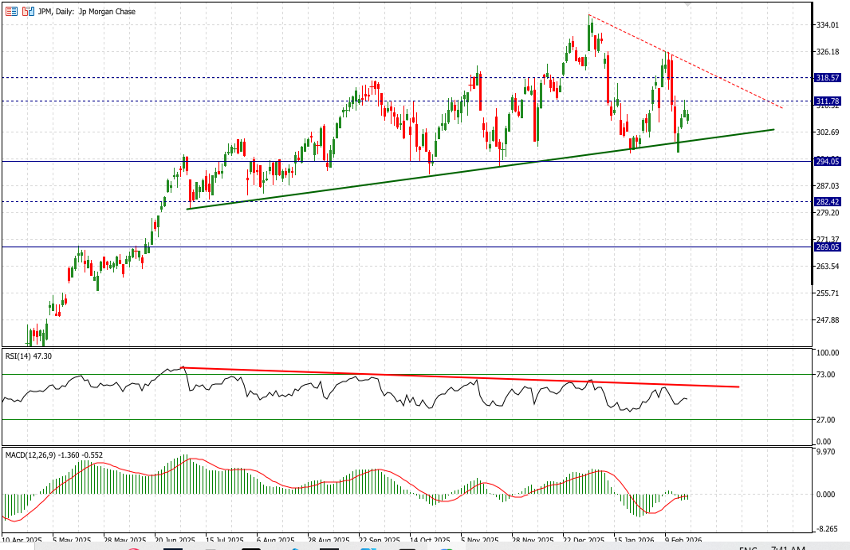

TECHNICAL ANALYSIS

JPM, like several other stocks, is trading near its all-time highs, yet it has nevertheless struggled to advance convincingly for several months. From lows around $280 in early July, yesterday’s close was $308.5, while the absolute highs were reached at $336 earlier this year (01/05).

Price has settled along a rising trendline, albeit with a very shallow slope, and has repeatedly found support there. As recently as last Friday, the stock opened below that trendline but quickly attracted sufficient bid interest to be pushed back above the area in question. Meanwhile, technical indicators have cooled off, and the RSI—currently at 47—shows a clear and prolonged divergence, which is not a constructive technical signal.

To the upside, there are two important technical levels at $312 and $318.5, which act as resistance before what appears to be the beginning of a bearish trendline, currently positioned around $322.

A close below $300 in the coming sessions would be technically negative and would immediately put the nearby support around $294 to the test. Only below that level would we see more pronounced downside pressure, initially toward $282.50 and then $269.

More broadly, while the banking sector has been a significant contributor to the latter stages of this market rally, valuations, latent risks, and a trajectory of declining interest rates suggest a degree of long-term caution is warranted.