US30 Pulls Back from All-Time Highs

There was a time—not long ago—when the digital economy was far less developed, and any competent market analyst could not ignore a particular index: the Dow Jones Transportation Average. This index is effectively the sibling of the US30, more properly known in full as the Dow Jones Industrial Average.

The underlying concept is straightforward: to seek confirmation of the strength of the US30’s movement by observing an index that tracks transportation and freight activity. After all, if the economy is performing well, consumer goods must be shipped and distributed, and the companies responsible for these operations should benefit accordingly. A new high in the Dow Jones Industrial not accompanied by a corresponding move in the Dow Jones Transportation could therefore signal the need for further confirmation.

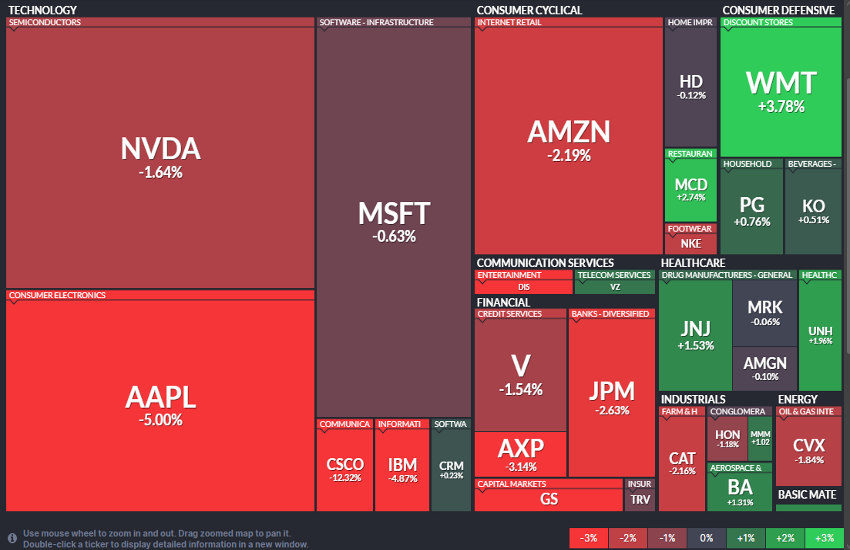

I mention this because yesterday, while the US30 retraced from its all-time highs with a -1.34% pullback, the Dow Jones Transportation declined sharply by -4.04%. It is important to note that the losses in the US30—as visible in the heat map below—remain largely attributable to big tech. Apple Inc. recorded its worst day in nearly a year, and the only sectors in positive territory were Consumer and Health Care.

However, concerns surrounding AI are now shifting to a new front—one that perhaps should have been more evident—beyond the immense (and hopefully justified) CAPEX expenditures of major corporations. AI, even in its current state, is already highly effective across multiple industries, placing lower-specialization white-collar roles at risk. Last week, we observed selling pressure in the software sector (particularly SaaS), before that in financials; now, the trucking and logistics sector is being hit hard—especially following news that a company called Algorythm Holdings has introduced an AI system reportedly capable of scaling large freight operators’ activities by 300–400%.

The key takeaway here is the following: all labor-intensive business models are potentially vulnerable to AI-driven disruption.

TECHNICAL ANALYSIS

It is always encouraging—at least from a technical perspective—to identify an instrument that respects trendlines and channels with precision. Some markets exhibit this behavior more consistently than others, and the US30 is one such case.

The ascending channel in place since May has been remarkably clean. On Tuesday and Wednesday, price action tested the upper boundary of the channel, and yesterday the market was pushed back below the previous all-time high in the 49,600 area.

In the coming sessions, price is likely to test the lower boundary of the channel, which currently comes in around 47,850. However, this level will probably converge with another key support area near 48,400 by the time it is reached. The reaction in that zone will be critical in determining whether the current uptrend has additional legs or is approaching exhaustion.

Momentum indicators are gradually unwinding but remain in positive territory, suggesting that bullish structure is still intact for now.

Finally, do not overlook today’s release of the U.S. CPI at 14:30 CET. Based on current pricing in the options market, a significant volatility expansion is expected.