USD/CAD Amid Trade Tensions and Policy Divergence

Canada is the United States’ second-largest trading partner after Mexico, with total bilateral trade reaching $770 billion in 2024. Of this, $422 billion consisted of U.S. exports and $349 billion of imports, resulting in a U.S. trade surplus of USD 73 billion. Canada, the U.S., and Mexico operate under the USMCA framework, which came into force in July 2020 to replace NAFTA and strengthen continental integration through enhanced market access, stricter labor provisions, and reinforced intellectual property protections across North and Central America.

Given this level of economic interdependence, it is unsurprising that President Trump’s early-year announcement of broad tariffs—25% on most imports effective March 4, 10% on energy products, and the reinstatement of steel and aluminum duties beginning March 12—triggered a significant trade confrontation, with Canada retaliating on up to $155 billion of U.S. goods. The measures sharply reduced bilateral goods flows, which fell 12.5% YoY through October following an initial surge in front-loading activity. Cross-border trucking volumes jumped 50% in January–February (notably on Toronto–Chicago lanes), freight rates increased 10%, and expedited shipments doubled as firms rushed to build inventories ahead of the new duties. By contrast, passenger vehicle border crossings dropped 20% from January to October, exerting acute pressure on the automotive, metals, and energy sectors—all of which are tightly linked to USMCA rules of origin.

In addition, monetary policy divergence has become more pronounced. The Bank of Canada—which met yesterday in parallel with the Federal Reserve— left its policy rate unchanged at 2.25%. The central bank had initiated an aggressive easing cycle in June 2024 from a peak of 5% but recently paused due to evidence of a labor-market rebound, with unemployment easing to 6.6 percent, and a steady deceleration in CPI to 2.2 percent, approaching the Bank’s inflation target. On the other hand, the Fed cut rates by 25 basis points yesterday: let’s examine how these developments have affected the USD/CAD exchange rate and what to expect going forward.

TECHNICAL ANALYSIS

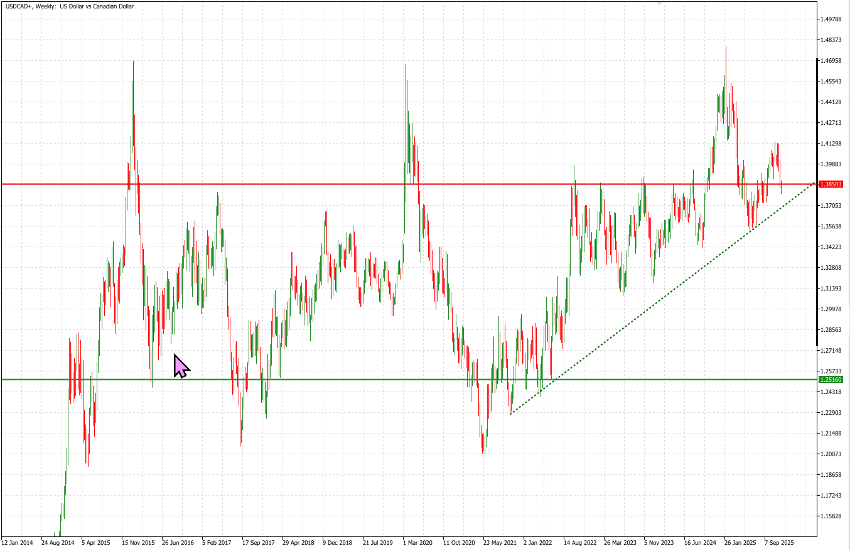

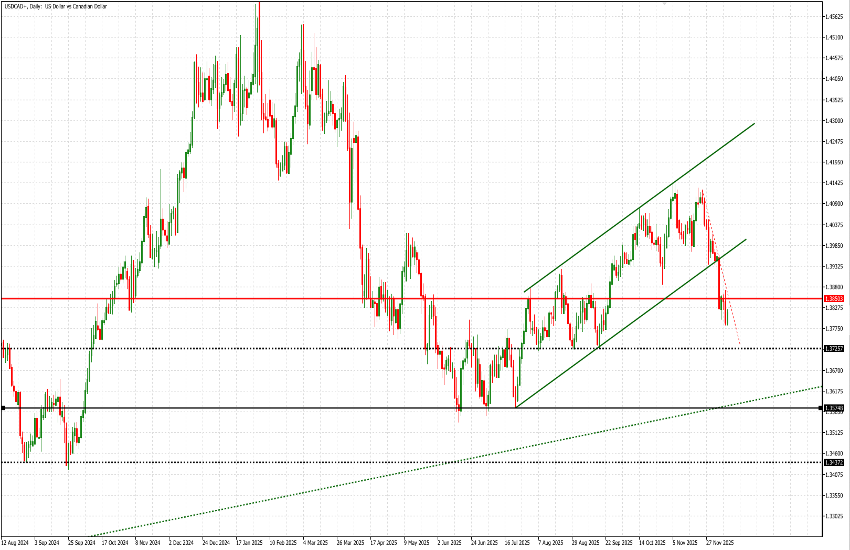

The pair has been accurately reflecting the underlying political and macroeconomic dynamics in its price action. The Canadian dollar weakened from 1.3419 in September 2024 to a January low of 1.4560, driven by the Bank of Canada’s easing cycle. It subsequently recovered meaningfully, with USD/CAD falling to 1.3566 in June of this year, as reduced demand for U.S. dollars translated into depreciation of the greenback. After roughly a month of consolidation, the U.S. dollar resumed its advance on July 23, and the pair traded within a well-defined upward channel. This structure, however, broke down on December 5, when—ahead of yesterday’s respective central bank rate decisions—the trend was breached to the downside at 1.3956. Yesterday’s closing settlement printed at 1.3790.

Looking at the longer-term structure, the 1.3850 area is a critical level, as USD/CAD has oscillated mostly between this zone and 1.2520 since roughly 2015. Taking this into account, along with persistent trade-war dynamics and a Canadian economy that appears to be showing solid underlying resilience (particularly the consumer sector), the bias favors continued downside in the weeks ahead. Key levels to monitor include 1.3725 and 1.3575 initially. Somewhat lower, the 1.3430 region is also noteworthy. Naturally, this view pertains to a medium- to long-term horizon, likely extending into early 2026.