USD on the Move, FX Markets in Turmoil

After months of relatively subdued volatility in FX markets, conditions have shifted abruptly. Over the past four sessions, the USD Index has recorded its worst performance since April 2025 (the days following the initial tariff announcements). With a -0.83% decline yesterday, the greenback has depreciated to levels last seen four years ago, in February 2022. Both the intraday low at 95.21 and the close at 95.45 are well below the 96.40 floor (support) that had held consistently since May 2025.

The DXY is a futures-based index that summarizes the strength of the US dollar against six major counterparts. Every move in the index reflects tangible developments across FX markets. A wide range of currency pairs have moved sharply, breaking key technical levels across both traditional safe-haven currencies (CHF and JPY) and commodity currencies (notably AUD and CAD—currencies of resource-rich economies, typically considered high beta and more sensitive to global risk sentiment).

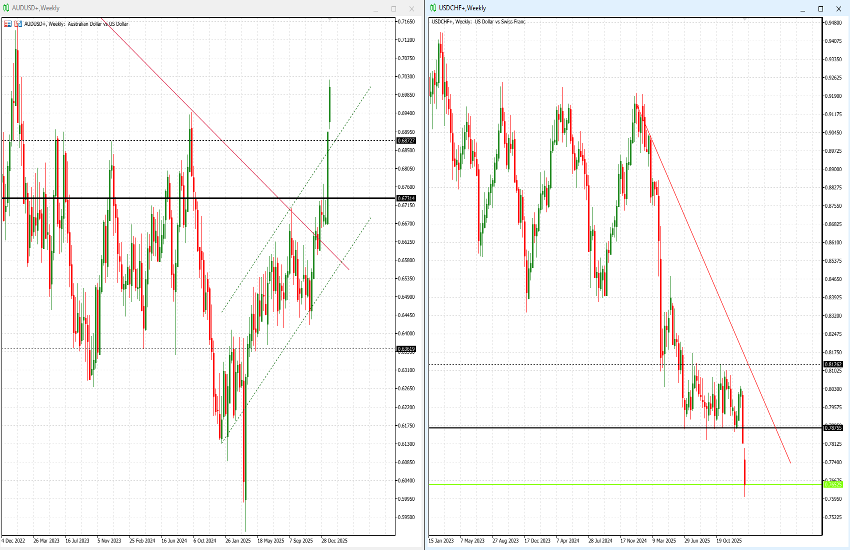

Given the breadth of moves, it is not possible to cover all pairs in a single note. We therefore begin with the most significant developments, starting with AUD/USD, which has gained +4.86% , settling +1.29% yesterday at 0.6997. The pair decisively broke through resistance in the 0.6700–0.6740 area and—importantly—initiated its rally ahead of most other major currencies. One of the key drivers of renewed USD weakness has been a market rumour that emerged last Friday suggesting that the Fed’s trading desk may be preparing for a potential coordinated intervention with Japan to stem the yen’s depreciation. Such an intervention would involve buying JPY and selling USD, whether in the spot market or via swaps. Against the Australian dollar, however, the move had already begun earlier, likely supported by the strength in gold, of which Australia is a major exporter.

As the yen has already been discussed in recent days, attention here turns to the other key safe-haven currency: the Swiss franc, whose move has been particularly clear and forceful. USD/CHF swept decisively through the previous support at 0.7875, settling yesterday at 0.7629, representing a +4.21% appreciation of the Swiss currency over just three trading sessions. This comes alongside notable moves elsewhere, including EUR/USD breaking above 1.20 and GBP/USD trading above 1.38 for the first time since late 2021.

All of this is unfolding just hours ahead of tonight’s FOMC meeting, from which markets expect no policy changes (as reflected in Fed Funds futures). The focus will instead be on forward guidance for the remainder of the year, with one to two additional rate cuts currently priced in, potentially in June and December. That said, the meeting is also likely to attract attention due to questions around political pressure and the Federal Reserve’s independence. These concerns stem not only from the situation involving Jerome Powell—currently under DOJ investigation, reportedly amid pressure from Trump—but also from scrutiny surrounding Governor Lisa Cook (also under investigation over alleged mortgage fraud), the upcoming end of the term of the “super-dove” Miran (strongly backed by Trump), and the anticipated announcement of Powell’s successor, expected within the next few days and possibly hinted at as early as today.

We conclude this chart-heavy update with an additional observation unrelated directly to the USD. EUR/CHF is showing signs of weakness, reflecting the pronounced strength of the Swiss franc—likely, at least in part, linked to the ongoing rally in gold. The pair is currently struggling around the 0.92 support area, trading near 0.9183, without yet achieving a decisive break. This is a level worth monitoring closely in the coming sessions.