VIX: Equity Volatility Remains Subdued

While volatility across multiple asset classes has increased steadily over recent weeks—something we have all observed—the VIX index, which reflects equity market volatility and more specifically options on the S&P 500 maturing within 30 days, has remained relatively subdued. To be fair, the VIX has attempted to rebound a couple of times over the past two weeks; however, upon reaching non-extreme levels around 20.50, it was aggressively sold and quickly pushed back down.

By contrast, the gold volatility index (GVZ) has surged recently from the 20 area to around 45, reaching a peak close of 46.02 on January 29. This represents a level not seen in at least five years, according to the data shown in the chart below. Over the same period, the U.S. Dollar Index has experienced a marked increase in daily trading ranges, expanding from roughly 40 cents to more than 80 cents per session over the past ten days, driven by the sharp sell-off in late January followed by the rebound seen over the last four sessions.

Meanwhile, the February VIX contract (which is a future and rolls on the third Tuesday of each month) continues to trade within a relatively tight range between 17.80 and 20.50. The week started poorly for equity markets yesterday morning, with sharp declines; however, a strong U.S. PMI release—beating expectations across the board, from new orders to labor market conditions, and most notably showing an unexpected return of manufacturing activity into expansionary territory—triggered a nearly 2% intraday rally from the lows in U.S. equity indices, with a comparable performance across European markets. As equities rise, volatility is typically sold, reflecting reduced demand for downside protection.

TECHNICAL ANALYSIS

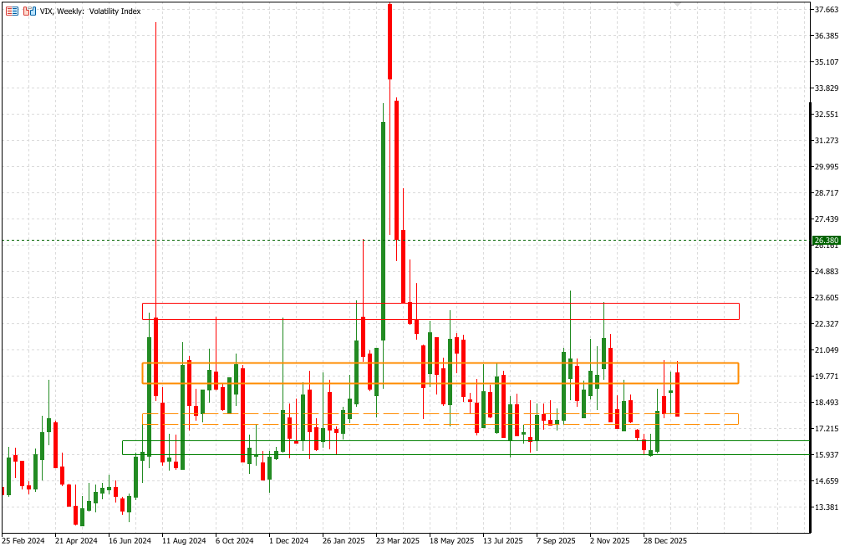

We present a weekly chart for clarity of visualization. The zones we have highlighted represent areas of accumulation and distribution which, at least over the past year, have also helped identify equity market bottoms. The 16.00–16.50 area (green rectangle) can be considered a low-volatility zone; in recent months, the VIX has rarely traded below this range, making it a reasonably reliable accumulation and buying area for the instrument.

Conversely, the 22.50–23.40 zone (red rectangle) has consistently acted as a strong rejection area—attractive for selling VIX—and has historically coincided with equity market bottoms on the S&P 500. The last two candles that tested this zone in October and November of last year correspond to the two sessions that sharply pushed the S&P 500 down to 6,550 (it is currently trading around 6,997). Over the past few years, this area has only been decisively breached twice, most recently during the initial tariff announcement; therefore, when such a breakout occurs, it warrants close attention.

What we are observing in recent sessions, with the 19.50–20.50 range (orange rectangle) capping price action, represents a transitional zone and a state of indecision. However, a key observation is that when this consolidation forms after a move up from lower levels—specifically from the 16 area—it has historically preceded a genuine volatility spike a few weeks later. This was the case in January–February of last year and again in October.

On a daily timeframe, we are monitoring the current contract’s downside levels at 17.65, followed by 17.35, and potentially a full gap closure from the rollover at 16.70. Such a move would clearly imply new highs in equity indices, should it materialize. For reference, the March 2026 VIX contract is currently trading around 19.10.