Daily Technical Analysis: EUR/USD Falls Below 1.1400 After Positive US Data and Weak French CPI

The EUR/USD pair continues its decline, slipping below the 1.1400 level for the second consecutive session, pressured by a rebound in the US Dollar (USD) and soft inflation data from France. As of Tuesday, the pair trades at 1.1335, down over 0.40%.

Rebounding Dollar Gains From Strong Confidence Data

A recovery in risk sentiment followed comments from US President Donald Trump, who noted that trade negotiations with the European Union (EU) had gained momentum after he threatened 50% tariffs last Friday. Though he softened his stance, uncertainty remains over whether a deal will be reached before the July 9 deadline.

The latest boost to the greenback came from May’s Consumer Confidence data, which surged to 98.0 — the highest level in four years, according to the Conference Board. Stephanie Guichard, a senior economist at the CB, noted the rebound began even before the US-China trade deal on May 12 and accelerated afterward. The US Dollar Index (DXY) rose more than 0.62% to 99.54 following the data release.

Elsewhere in the US, April Durable Goods Orders plunged 6.3% month-over-month, the lowest reading since October 2020, though slightly better than forecasts of a 7.8% drop.

French Inflation Misses Expectations, Weighs on Euro

In the Eurozone, French inflation data further weakened the euro. France’s Harmonized Index of Consumer Prices (HICP) rose just 0.6% year-over-year in May, down from 0.9% in April and below expectations — marking the lowest level since December 2020. This supports market speculation that the European Central Bank (ECB) may ease policy further.

ECB policymaker Gediminas Simkus signaled the possibility of a rate cut in June. However, contrasting views exist within the institution — Austrian central banker and ECB member Robert Holzmann told the Financial Times that he sees no reason for cuts in the upcoming meetings.

Despite mixed messages, sentiment indicators improved slightly. The EU Economic Sentiment Indicator rose for the first time in three months in May, aligning with the German GfK Consumer Sentiment Index, which climbed from -20.8 to -19.9, though it missed forecasts of -19.

On a broader note, ECB President Christine Lagarde remarked on Monday that the euro has the potential to become a global reserve currency rivaling the US dollar — if the Eurozone strengthens its financial and security frameworks.

Markets widely expect the ECB to reduce its Deposit Facility Rate by 25 basis points to 2% at next week’s policy meeting.

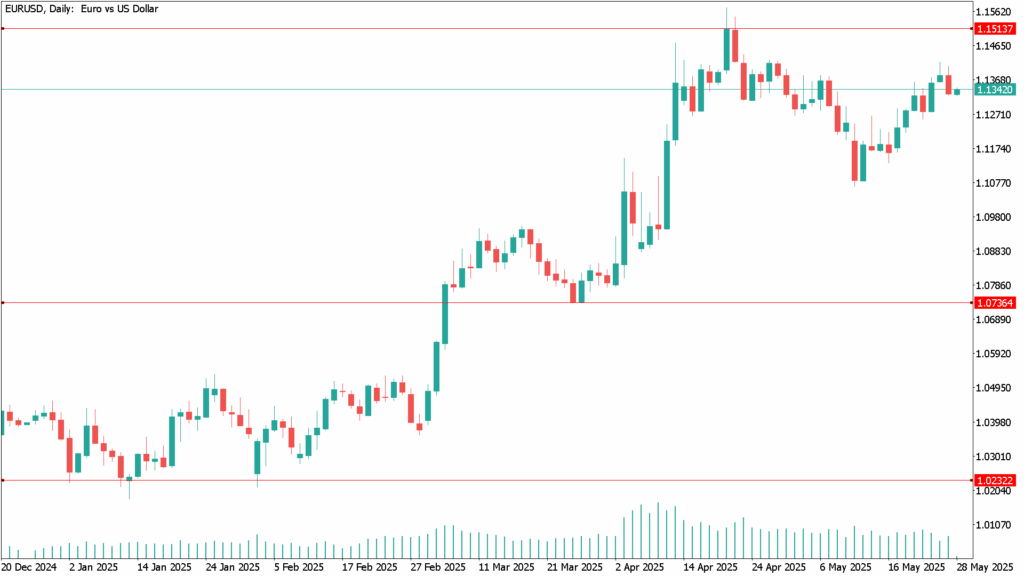

EUR/USD Daily Technical Analysis for May 28th

EUR/USD maintains a bullish bias overall but has faced persistent resistance near the 1.1400 mark. Monday’s price action formed an “inverted hammer” candlestick pattern — often seen as a potential reversal signal. The subsequent drop below Monday’s low of 1.1358 adds weight to bearish pressure.

A daily close under this level could pave the way for a deeper pullback toward 1.1300. Further support lies at the 20-day Simple Moving Average (SMA) near 1.1267, followed by 1.1200.

To the upside, if the pair regains footing above 1.1375, resistance levels are seen at the May 26 high of 1.1418, then 1.1450, and potentially 1.1500.